Staying Compliant: A Startup Founder's Guide to New Company Laws

Today’s article focuses on the new regulations aim to increase transparency and crack down on economic crime. This means big changes for startups, including stricter identity verification, physical office addresses, and a focus on lawful business activities. Companies House gains new powers to enforce these rules, with potential penalties for non-compliance.

In October 2023, the Economic Crime and Corporate Transparency Act 2023 (ECCTA) received royal assent, marking a significant milestone in the evolution of UK company law. These changes, set to transform operations within Companies House, carry implications that founders of startups need to understand and adapt to.

The ECCTA has broadened the scope of the identification principle, extending liability to companies for specific criminal offenses such as bribery, tax evasion, money laundering, fraud, and false accounting. This liability applies when the offense is perpetrated by a "senior manager" within the confines of their actual or perceived authority.

Under the ECCTA, Companies House as the Registrar of Companies in the UK, has been granted further powers to scrutinise, decline or eliminate inconsistent data from the register. Particularly, filings may be rejected or scrutinised if they conflict with previously submitted information. Further, Companies House is empowered to eliminate any data that appears to be ambiguous or deceptive. and now possesses enhanced capabilities to exchange information with various government bodies and law enforcement agencies, including HM Revenue & Customs.

Implementation of the ECCTA will be in stages as many will need systems development and secondary legislation before they can be implemented, including amendments to the Companies Act 2006. While the implementation timetable is being finalised, Companies House is getting itself ready to be in a position to enforce its new powers.

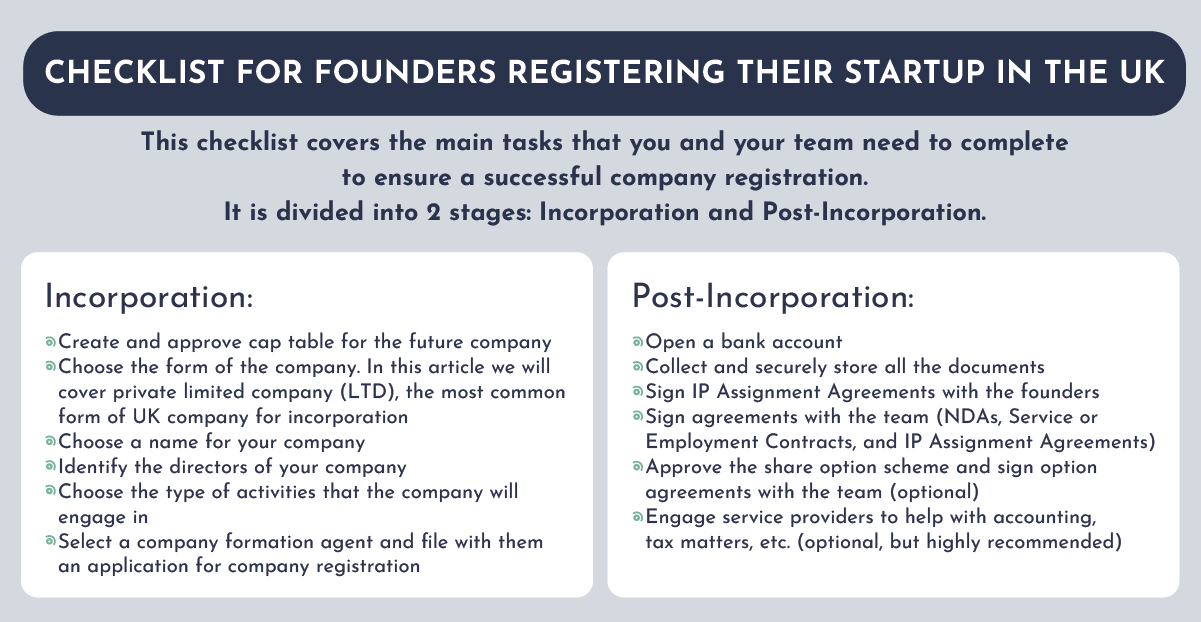

Some of the key company law reforms are as follows:

Identity Verification:

Startup founders, directors and Persons of Significant Control (PSCs) must now provide identification as part of company registration. Exceptions exist for employees or officers of authorised corporate service providers. While verification is typically one-time, repeat verification may be necessary in certain cases.

Registered Office Addresses and Email Addresses:

Effective from 4 March 2024, PO boxes are no longer accepted as registered office addresses. Companies must maintain a physical address capable of receiving official documents, with Companies House having the authority to change addresses deemed unsuitable. Should the companies address be deemed unsuitable they will be given 28 days to provide evidence of suitability.

Companies are also now required to provide a registered email address for correspondence and communications. Companies incorporated after 4 March 2024 will be required to provide the email address as part of incorporation and existing companies will have to provide the email address in their next confirmation statement.

It is essential companies should ensure that its registered addresses (both physical and email addresses) meets the criteria to avoid disruption to your business operations.

Statement of Lawful Purpose:

Companies incorporated after 4 March 2024, must confirm their lawful purpose upon incorporation and affirm the legality of their activities in subsequent confirmation statements. It's vital for startup founders to clearly articulate their company's purpose and ensure ongoing compliance with applicable laws and regulations.

Registrar Powers:

Companies House gains authority to investigate and remove inaccurate, incomplete, false, or fraudulent information without requiring a court order.

Company Registers:

The ECCTA will abolish the need for companies to maintain statutory registers such as register of directors, the register of directors’ residential addresses, the register of secretaries, and the PSC register at their registered office address. These registers will be held centrally by Companies House.

Companies must however still maintain its register of members and it is no longer possible to maintain a central register at Companies House. It is therefore essential to ensure that all the information contained in these registers are accurate and up to date.

Companies must ensure they have fulfilled their obligations by identifying any PSCs and RLEs, issuing notices as required, and maintaining accurate records in their PSC registers.

These measures are not yet in force and a date has not yet been set for when this will happen, so right now is still a legal requirement to keep all of the above statutory registers locally by the company.

Enforcement and Sanctions:

Non-compliance with Companies House formal requests, within 14 days of receipt, can result in sanctions, including financial penalties, annotations on records, and prosecution.

Confirmation Statement:

As of 4 March 2024, companies must provide a registered email address for Companies House communications with confirmation of future lawful activities.

Companies House Fees:

New fees for Companies House filings and incorporations will become payable from 1 May 2024.

Transparency of Company Ownership:

Companies must disclose full names of individual shareholders and corporate members on the Companies House register, along with additional information on PSCs. Restrictions on corporate directors limit appointments to UK entities with legal personality.

Accounts:

Companies House transitions to online-only company account filing, with small and micro entities required to file profit and loss accounts. Abridged accounts filing is discontinued, and companies claiming audit exemptions must provide additional director statements specifying qualifying exemptions.

As companies navigate these changes, it is imperative to stay informed and ensure compliance with the updated regulations. Given these substantial changes, companies must undertake a thorough review of their current policies and procedures to assess their effectiveness in detecting and mitigating fraud and economic crime-related risks. The ECCTA expansion of offenses and circumstances attributable to corporate employers necessitates a re-evaluation of existing measures. Establishing robust fraud prevention protocols, for which forthcoming UK government guidance is anticipated, is paramount.

Companies may also find it prudent to identify potential "senior managers" or "associated persons" who fall under the purview of the new regulations. Implementation of comprehensive training programs is essential to ensure that employees are equipped to recognise and report behaviours that could expose the company to liability under the reformed legislation.

Key takeaways for founders:

Verify your identity and that of People with Significant Control (PSCs).

Maintain a physical office address and a registered email address.

Clearly define your company's lawful purpose.

Ensure accurate records and reporting.

Develop fraud prevention protocols and train employees.

For more bespoke advice on navigating Companies House reforms, company secretarial services and company policies schedule a call with one of our Corporate and Employment advisors.

Speak to one of our Corporate Law Solicitor today ↓

Written by: