Don't Forget Your R&D Tax Credit Claim

Tax Accountant for Startups & SMEs

Is your business missing out on a potential vital cash injection? Or could you reduce your corporation tax liability freeing up cash to invest in growth?

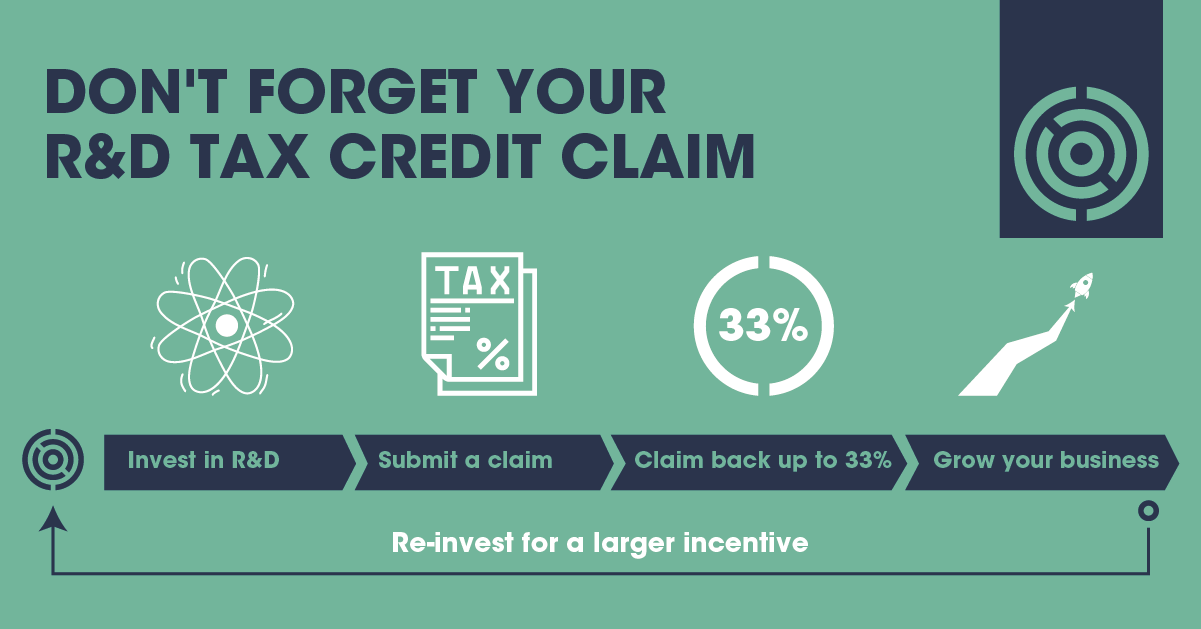

HMRC estimates that approximately 75% of businesses that could qualify for R&D tax credits don’t make a claim. As many companies will have recently completed their statutory year end accounts, now is the perfect time to submit an R&D claim. Dragon Argent, startup tax accountant have a handy R&D tax credits calculator to give clients a sense of what a claim could mean for their business - and in this week’s newsletter, we'll also provide a recap on the research and development tax credit essentials every business owner should know.

What are R&D Tax Credits?

R&D Tax Credits reward companies that invest in innovation and help fuel sustainable growth. R&D tax relief could be as much as 25% of the cost of an eligible project. For a loss-making company, a cash rebate of up to 33.5% is available in lieu of tax relief, which is often paid within 4 weeks of a successful claim being made.

R&D tax relief or rebate could make a huge difference to a bootstrapping startup - and is therefore well worth taking the time to investigate.

Does Your Business Qualify?

A UK incorporated limited company can claim R&D relief up to two years after the end of the accounting period of eligible expenditure. The following are flags that you could be eligible:

You are innovating, improving, or inventing processes or technologies which are not currently available on the market.

At the start of the project, you had no clear answer as to how the project would conclude. This uncertainty proves the first point that the development is producing new knowledge.

You can document evidence of your research and development, and the expenditure relating to these activities.

Eligible Costs

If your company meet the R&D tax relief criteria laid out above, you should endeavor to maintain detailed records of every cost associated with the project, including:

Staff costs associated with the project.

Subcontracted staff associated with the project.

Software associated with the project.

Consumables: Any utilities or materials used in the project are eligible.

N.B. Ineligible costs include the costs of distributing the goods produced, capital expenditure, rent or rates, and the cost of patents.

Tax Accountant for Startups & SMEs for UK Businesses

If based on the above, you think your business would qualify and you have eligible costs which you could claim again, use our R&D Tax calculator here to get an estimate of the value of a rebate. Alternatively, schedule a call with Misha Patel, our R&D specialist based in London, if you would like to discuss a prospective claim.

Book a call with R&D Tax Credit Specialists ↓

#randtaxcredits #randclaims #claimback #startups #claims #businessgrowth

Categories

- (S)EIS Tax Relief

- Accountancy Best Practice

- Art and Luxury Assets

- Business Immigration

- Commercial Law

- Commercial Litigation

- Corporate Law

- Corporate Strategy

- EMI Share Option Scheme

- ESG Compliance

- Employment Law

- Fundraising Strategy

- Human Resources

- Intellectual Property

- Merger and Acquisition

- NFTs and Digital Trading

- R&D Tax Credits

- Startups & SME Advice

- Tax Advice

- UK Subsidiary